Industrial property lending in Colorado drives economic growth, offering specialized financing for manufacturing, logistics, and distribution sectors. Lenders assess projects based on location, property value, tenant relationships, and industry viability, with competitive interest rates and flexible terms. Mixed-use development requires strategic financing, analyzing local trends, diverse revenue streams, collateral, zoning laws, environmental impact, infrastructure, cost estimation, and occupancy rate projections. Understanding these nuances facilitates sustainable mixed-use projects tailored to Colorado's diverse communities.

Mixed-use development financing is a dynamic aspect of Colorado’s real estate landscape, driven by a robust industrial property lending market. This article delves into the intricacies of industrial property lending in Colorado, exploring key factors that influence mixed-use projects. We navigate the challenges and opportunities unique to this state, providing insights for developers and investors. By understanding these dynamics, stakeholders can capitalize on Colorado’s thriving market and contribute to its diverse and sustainable growth.

- Understanding Industrial Property Lending in Colorado

- Key Factors for Mixed-Use Development Financing

- Navigating Challenges and Opportunities in Colorado's Market

Understanding Industrial Property Lending in Colorado

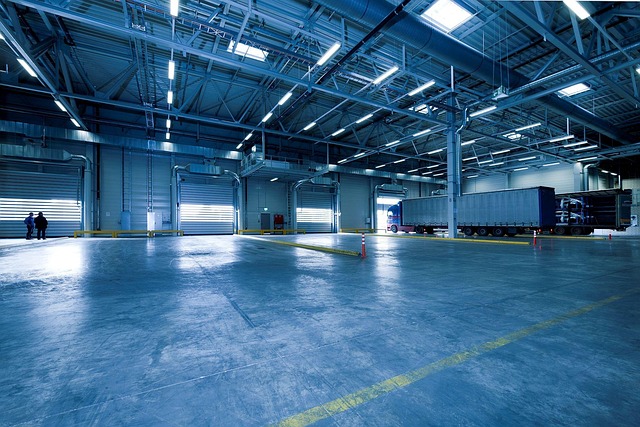

In Colorado, industrial property lending plays a pivotal role in shaping the state’s dynamic economy. This type of financing is tailored to support the development and acquisition of commercial real estate, with a specific focus on industrial facilities. Lenders offer various financial products designed to cater to the unique needs of businesses operating within the manufacturing, logistics, and distribution sectors. Understanding this specialized lending sector is crucial for both developers and potential borrowers looking to navigate Colorado’s market.

Colorado’s industrial property lending landscape is characterized by a mix of traditional banks, specialized mortgage lenders, and alternative financing options. Lenders assess projects based on factors such as location, property value, the strength of tenant relationships, and the long-term viability of the industry sector. Given the competitive nature of the market, developers can access competitive interest rates and flexible terms, making it an attractive option for mixed-use development projects across the state.

Key Factors for Mixed-Use Development Financing

Mixed-use development projects in Colorado, particularly those involving industrial property lending, require a careful balance between financing strategies and market dynamics. Key factors include understanding the local economy, assessing the project’s revenue streams, and securing robust collateral. Lenders must evaluate the potential for sustainable income generation from diverse components like residential, commercial, and industrial uses to mitigate risks associated with such ventures.

Additionally, compliance with zoning regulations, environmental considerations, and infrastructure availability play significant roles in determining financing feasibility. Effective financial planning involves assessing development costs, construction timelines, and projected occupancy rates. Robust market analysis, coupled with a comprehensive understanding of these factors, enables informed decision-making in the competitive landscape of industrial property lending in Colorado.

Navigating Challenges and Opportunities in Colorado's Market

Colorado’s market for mixed-use development presents a unique blend of challenges and opportunities, particularly in the realm of industrial property lending. The state’s booming economy and diverse population have fueled strong demand for versatile real estate that can accommodate both residential and commercial uses. This dynamic creates a fertile ground for innovative financing strategies, as developers seek to capitalize on the rising value of industrial properties.

Navigating this landscape requires a keen understanding of local market trends and regulatory environments. Industrial property lending in Colorado demands careful consideration of factors such as zoning regulations, infrastructure availability, and transportation networks. Lenders who embrace these complexities can unlock significant opportunities, facilitating the development of sustainable mixed-use projects that cater to the evolving needs of Colorado’s diverse communities.

Mixed-use development financing in Colorado presents a dynamic landscape, with industrial property lending playing a crucial role. By understanding key factors and navigating market challenges, investors and developers can unlock substantial opportunities. With the right strategies, Colorado’s thriving industrial sector can continue to foster economic growth while creating vibrant mixed-use communities. Industrial property lending remains a vital tool for shaping the state’s future, ensuring a balanced blend of commercial, residential, and recreational spaces that cater to the diverse needs of Colorado’s residents and businesses.